Brisbane's Innercity Premium Apartment Market & Economic Outlook

As we near Christmas, I thought it was appropriate we start to look at Brisbane’s premium apartment market given that the few that have been under construction, are now starting to reach completion. This will focus particularly on those river front suburbs.

ECONOMIC LANDSCAPE

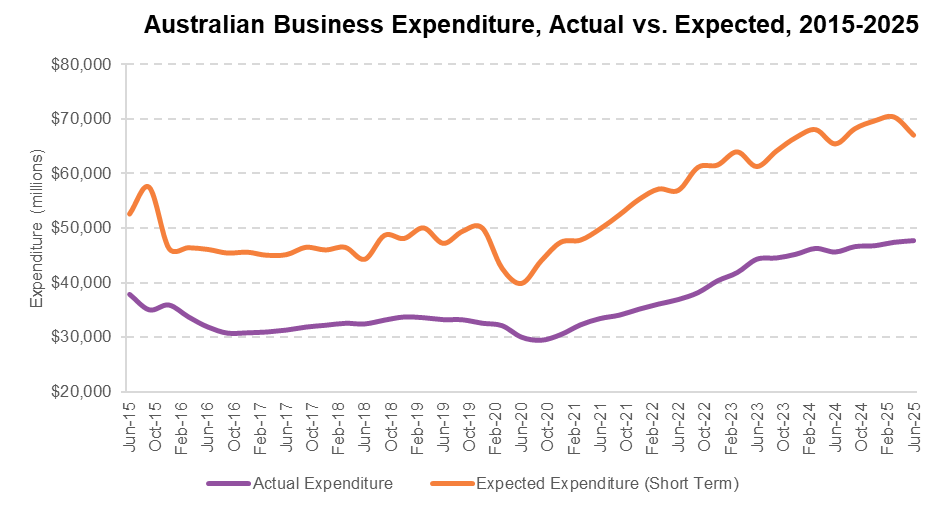

Australia’s broader economy continues to present contrasting signals. On the positive side, firm mineral prices, strong equity markets, robust business investment intentions, and a substantial infrastructure pipeline are all reinforcing economic resilience. Additionally, real wages have begun growing again, and labour markets remain tight, with most economists agreeing the nation is at or near full employment. An important measure for the RBA in its considerations for how the economy is performing.

However, the picture is far from uniformly positive. Consumer confidence remains stuck below pre‑pandemic neutral levels, while inflation—especially in services and housing—continues to be sticky with the latest CPI data suggesting interest rate moves will be up. Some cycles are longer than others, unfortunately for many, the low interest rate cycle was not one of them. Productivity growth remains subdued, and savings buffers built during the pandemic have largely normalised. Importantly, these pressures are having little noticeable effect on the premium end of the residential market, suggesting that the affluent buyer segments maintain both the appetite and capacity for high‑value acquisitions.

POPULATION GROWTH & HOUSING DEMAND

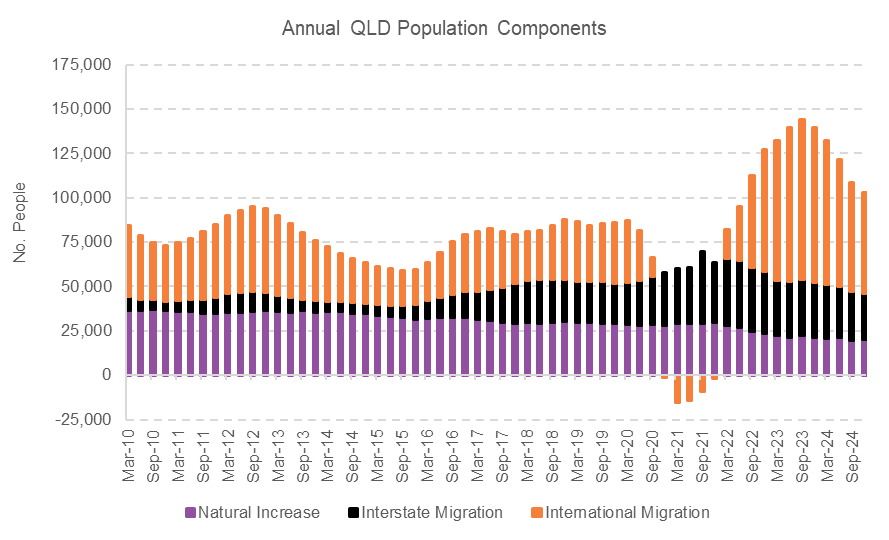

Queensland continues to experience nation‑leading population growth, which remains ahead of dwelling supply. This imbalance has become a key driver in the continued upward pressure on values, particularly within established, inner‑suburban precincts such as those river facing suburbs like Kangaroo Point, South Brisbane and New Farm to name a few.

Greater Brisbane dwelling approvals remain broadly in line with the historical average; however, unit approvals are well below the peak levels of 2015–2016. This is inconsistent with regional planning targets that call for far greater infill density. Slow project delivery and persistent construction costs have narrowed the price gap between new and established products, supporting continued price strength in the premium established market where projects have A grade sites. The construction challenge remains for B grade sites and lower to reach a financially viable outcome that is palatable to the public.

FINANCE & INVESTMENT TRENDS

Financing activity across Queensland is largely aligned with population growth. Notably, investor participation has surged—doubling since 2019—with investors now outnumbering first‑home buyers two to one. Federal adjustments to the First Home Deposit Scheme are expected to lift activity among younger buyers, although this impact is unlikely to influence the premium apartment segment. Some may argue that this intervention has contributed to the latest round of inflation data that sits well outside the 2.0%-3.0% bracket the RBA targets.

Construction inflation has eased overall, settling around 2 percent year‑on‑year; however, key materials such as concrete, electrical components, and ceramics remain affected by global and domestic pressures. South‑East Queensland’s Olympics‑related infrastructure pipeline poses an additional medium‑term risk of re‑heating construction inflation, potentially impacting the viability of new projects and the sourcing of trades and labour.

BRISBANE’S LUXURY APARTMENT MOMENTUM

Brisbane’s prestige apartment market has undergone a dramatic transformation, with sales above $2 million more than quadrupling since 2020. These transactions are highly concentrated along the river, where lifestyle, aspect, and proximity advantages are most pronounced.

Kangaroo Point stands out with the highest rate of river frontage of any inner‑Brisbane suburb—31 metres per hectare. Despite being one of the smaller suburbs in terms of area, it ranks third in the number of apartment sales exceeding $2 million, behind New Farm and Brisbane City, in that order rounding out the top three.

SUPPLY PIPELINE OUTLOOK

Short‑term supply under construction across Inner Brisbane equates to roughly three years of typical absorption. This is modest relative to the peak years of 2015–2016, when delivery volumes were significantly higher.

Within the river‑facing segment, over 2,000 units are in the pipeline; however, many of these have already been sold. When restricting analysis to projects located within 2 km of the CBD, only 1,312 river‑facing units remain in the pipeline, highlighting an increasingly constrained future supply environment. These suburbs have typically worked in the apartment market due to the prestige nature and highly desirable destination to live. In addition, as white collar neighbourhoods, the proximity to the CBD makes transiting to work easy.

WEALTH DISTRIBUTION & BUYER DEMOGRAPHICS

National wealth metrics confirm that property and superannuation dominate household wealth, with higher‑net‑worth households disproportionately represented in metropolitan centres. Each quintile contains approximately 1.855 million households, but the upper quintile—those holding the highest concentration of wealth—demonstrate the strongest preference for premium residential assets.

Industry data indicate that ultra‑high‑net‑worth (UHNW) individuals are the only demographic that continues to accumulate property at scale, further supporting strong demand in the luxury segment and concerns for investing in Super given the rules continually change, removing certainty over the longer term.

PENTHOUSE MARKET DYNAMICS

Inner Brisbane contains just 93 river‑facing penthouses, with Kangaroo Point hosting more than any other suburb—29 in total. Nineteen of the next 24 forthcoming projects across Inner Brisbane are expected to include penthouses, but even so, fewer than 40 additional penthouses are likely to enter the market in the foreseeable pipeline. Historically, Brisbane penthouse resales have recorded average annual growth of 8.5 percent, underscoring both scarcity value and long‑term capital performance.

CLOSING OUTLOOK

Looking ahead, the combination of sustained population growth, limited new supply, and robust demand from high‑net‑worth households positions Brisbane’s Inner City luxury market for continued outperformance. While economic headwinds persist, their impact on the upper tier of the market is expected to remain minimal. The mismatch between demand and supply—particularly in river‑adjacent, prestige‑grade apartments—provides an ongoing foundation for anticipated value growth into 2026.

Matthew Gross | Director Nick Price | Associate Director