Australia's Million Dollar House is Average

For the first time ever, the average dwelling price in Australia has surpassed $1 million. Depending on whether you’re in the market or wanting to get into the market will depend on your perspective as to whether this is a good or a “throw your hands in the air” level of frustration moment.

Perhaps it is a little more than that. Since the pandemic, the cost of housing in Australia has increased extraordinarily. House construction prices have increased by 42.4%, though showing signs of actually coming back to a more reasonable annual increase of 1.1% which is below the ten year average of 2.6%. Apartment construction prices increased by 27.4% over the same period, though are still growing at circa 4.0%, which is well above the long term average of 2.1%. The HIA recently stated that 41% of the costs in a new house and land package are attributed to taxes and red tape. Not exactly consumer friendly. By default, this contributes to pushing the housing market higher. And for the record, the correlation between interest rates and house prices is pretty loose. The RBA sets its policy around significantly more than what the housing market is doing, it remains a consideration, nothing more and nothing less.

Interestingly, the higher house price, may actually go some of the way to making apartment projects and higher density (“Diversity” as my friend likes to all it) become more viable, adding supply to many communities in dire need of more supply. However, at what cost some will state given it will exclude many purchasers to which the counter argument is that it will mean more accommodation options for those in need and that is the priority right now. Both arguments have merit.

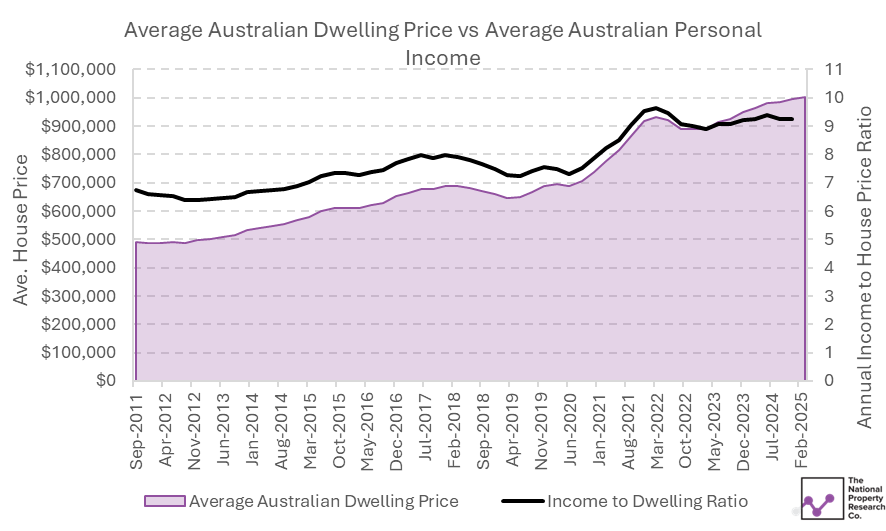

Over the period covered in the above graph, the average Australian house price has increased by 102% whereas the average individual income has increased by 48.3% by comparison. The opportunity to grow incomes is challenging when GDP in the last quarter came in at 0.2% leading many to speculate that a per capita recession is literally two quarters away. The day after the Federal Election, the Labour Government stated that they wanted to address the issues around productivity…and then at the press club recently the Prime Minister called for “anyone with ideas” to submit them to government. If productivity lifts, then there is scope for wage growth, though with the economy running at full employment, this will be like climbing Everest unassisted in your budgie smugglers.

Arguably the most important graph for anyone looking at entering the market is the relationship between incomes and dwelling prices. Whilst it is now 37% higher than in 2011, it has shown signs of coming back slightly and reaching a plateau. At circa 9 times annual earnings, there are possibly two things among many that will make this more palatable and likely to fall over time. Both are important;

1. Increase productivity and innovation so real wage growth can occur.

2. Remove some of the taxes and increase supply to slow dwelling price growth.

If we were really wanting to help first home buyers get into the market, perhaps we should extend the first home owners grant to the established market. Many of those houses in less affluent suburbs, older townhouses and three story walk up apartments would make great first homes…and maybe that grant would help get some buyers across the line.

A million bucks you say? It wasn’t that long ago when a millionaire was considered extraordinary.

Matthew Gross | Director | mgross@nprco.com.au