Booming capital gains for Gold Coast apartments

It’s no secret, price growth in South East Queensland’s coastal property markets has been incredibly strong in the past two years. As discussed in previous commentary pieces, migration and sales data trends are now supporting the notion that Covid-19 has impacted how and where people are choosing to live and work. With the increased prevalence of teleworking blurring the lines between work and home environments, this has reduced some of the desire for people to live in or near the traditional CBD. Whilst the author believes that more people will be returning to our CBDs in the short to medium term thanks to easing social distancing requirements, the rapid demographic change that has recently occurred has been financially beneficial for some, particularly those who own property in coastal markets like the Sunshine Coast and the Gold Coast.

Whilst much of this narrative has focused on houses in regional centres, higher density accommodation in places like the Sunshine Coast and the Gold Coast have reaped much of the same rewards, though cannot be put in the same box, given that they are both cities in their own right. Shifting the focus from regional housing in our previous discussion piece; The NPR Co. plans to delve into the performance of three different apartment resales markets since 2021, starting with the Gold Coast and future thought leadership pieces for the Sunshine Coast and Brisbane. Collectively, this research will shine a light on some of the best performing apartment markets in South East Queensland, whilst also providing an insight into how our coastal markets have performed in comparison to the city centric, Brisbane apartment market. In addition, insights into the top performing new projects will be provided, with due credit given to those developers who have provided the greatest financial returns for their clients, a goal that is often desired, but many times not achieved.

Gold Coast

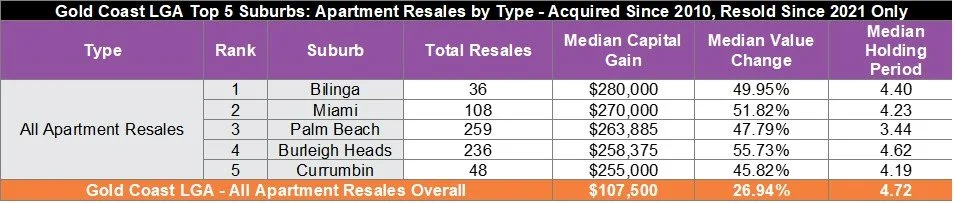

The table below provides a summary of the Gold Coast’s top five suburbs in terms of apartment resales performance since the start of 2021 by median capital gain. It is important to note that only those properties that had been acquired anytime since the start of 2010 and resold anytime since the start of 2021 have been included in the following analysis. Furthermore, only those suburbs with a minimum of five resales were considered for inclusion, in order to use somewhat reliable sample sizes.

Five of the six suburbs that accommodate a 15-kilometre stretch of sand from Miami in the north to Currumbin in the south have been the top performing suburbs in the Gold Coast. The only suburb along this stretch of sand that hasn’t featured in the top 5 is Tugun, though it has also performed well and is ranked 8th at a median capital gain of $244,250. Given the neighbouring proximity, the top five performing apartment markets on the Gold Coast obviously share similar physical characteristics and proximity to amenity. Importantly, most of these suburbs also share similar built form traits in regards to maximum building heights and housing density, particularly in Palm Beach, Currumbin, Miami and Bilinga.

Proximity to the ocean is an obvious focal point for each of the top five performing suburbs. As well as beach frontage, Burleigh Heads and Currumbin host their own creek and river mouth via Tallebudgera Creek (Burleigh Heads) and Currumbin Creek (Currumbin). This has the benefit of waterfrontage distributed across a much wider range of addresses, well beyond those that line the beach front. It is also a key selling point for Palm Beach which is bordered by each of these river mouths and benefits from proximity to both, as well as its own network of canals. At a time when lifestyle choices have been a key driver of migration and sales interest, the ability to offer proximity to the beach, the river and the canals, has become arguably more valuable than ever.

With regard to infrastructure, each of the Gold Coast’s top performing suburbs are situated within a 15km commute from the Gold Coast International Airport, whilst proximity to a number of reputable education facilities such as Palm Beach Currumbin State High School (Palm Beach), Marymount College (Burleigh Waters) and Southern Cross University are also key drawcards. Furthermore, as the two beachside suburbs located closest to the Pacific Motorway, accessibility in and out of Palm Beach and Currumbin has always bolstered the value proposition for permanent residents and those looking for a holiday home.

Looking ahead, those who have purchased in any of these top five suburbs will have been encouraged by a number of key infrastructure projects that will further improve connectivity for these southern Gold Coast suburbs via road and rail. Key major transport infrastructure projects that will benefit these locations include the $1 Billion upgrade to the Pacific Motorway from Varsity Lakes to Tugun that is currently under construction, Stages 3 and 4 of the Gold Coast Light Rail Project which will extend the route from Helensvale train station in the north to the Gold Coast Airport in the south and four additional future heavy rail stations that are proposed nearby in Tallebudgera, Elanora, Tugun and the Gold Coast Airport. Ultimately, each of these major projects will ensure that residents in each of the top five performing suburbs have direct public transport links to two international airports (Gold Coast & Brisbane), the $5 Billion Gold Coast Health and Knowledge Precinct and a countless list of other major employment and entertainment hubs that stretch along the Gold Coast shoreline, via Coolangatta, Broadbeach, Surfers Paradise, Southport and everything in between.

Another integral, common piece of the value proposition for most of these top five performing suburbs, particularly Palm Beach, Bilinga, Miami and Currumbin, is the comparatively small scale of development that is permissible. Height restrictions in each of these four suburbs sees new apartment projects limited to a maximum height of between just 3 and 7 stories under the current Gold Coast City Plan. Though 7 stories may be viewed as a considerable height for some, it pales in comparison to other suburbs like Broadbeach (35 stories), Surfers Paradise (no maximum height), Southport (no maximum height) and Coolangatta (25 stories). Smaller scale projects retain a greater sense of exclusivity which result in a greater share of public open space per capita, particularly beaches and waterways.

New Versus Established Resales

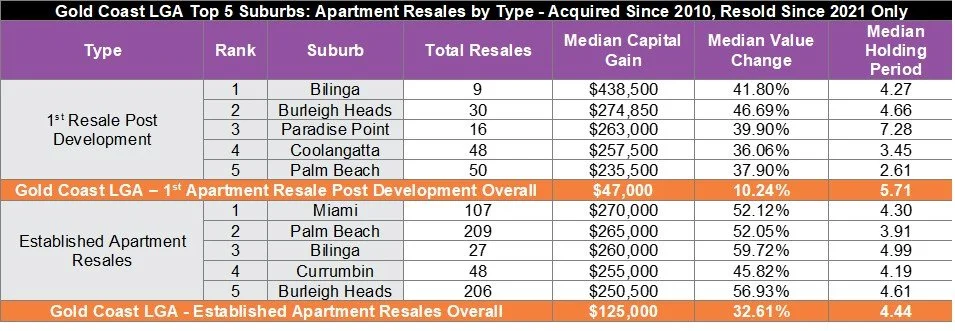

Delving further into the results presented above, the following table provides a breakdown of the Gold Coast’s top five apartment resales suburbs by product type, comparing results achieved by those who had purchased and resold established apartments and those who had resold an apartment that they had previously acquired brand new, from a developer. This is an important distinction to make as each product type hosts their own unique benefits, constraints and buyer profiles. Again, only those properties that had been acquired anytime since the start of 2010 and resold anytime since the start of 2021 have been included in the following analysis. Furthermore, only those suburbs with a minimum of five resales were considered for inclusion, in order to eliminate those with potentially skewed results.

Overall, those who purchased and resold an established apartment in the Gold Coast are shown to have typically fared better than those who have purchased directly from the developer at a median capital gain of $125,000 versus $47,000. However, when concentrating on the results of the top five suburbs in each cohort, there is little that separates the two product types with the average median capital gain being $293,870 across the top five developer markets and $260,100 across the top five established markets. Evidently, there has been greater variation between the top and bottom performing developer suburbs than there has been in the established market.

Again, apart from Paradise Point, the top performing suburbs across both product types are located in close proximity on the southern beaches of the Gold Coast. Notably, it is surprising to see such a considerable crossover between the top established and top developer markets. Typically, the best performing established suburbs are so tightly held and built out that developers are pushed to alternative locations in search of residual sites, which usually results in greater geographical variance between the two groups. However, and whilst occurring at a reasonably small scale, a handful of strategically acquired redevelopment sites has resulted in considerable gentrification in some suburbs like Palm Beach, Bilinga and Burleigh Heads. This has enabled such locations to feature in the top five for both product types. With the median holding period for the first resale post development being circa 29% longer than the median holding period for established properties in these three suburbs, it may be inferred that the new development that has occurred in these places has provided a more immediate uplift in value for surrounding, established properties.

Further to this point, a lack of readily developable sites combined with the smaller scale of development that is achievable along most of these southern Gold Coast beaches has proven highly beneficial for a sample of beachside property owners, particularly those in long established and small body corporate schemes. A deeper analysis of resales on an individual building basis undertaken by the author revealed that most of the top apartment resales results in the Gold Coast have been the result of strategic acquisitions for redevelopment purposes. Without revealing specific addresses, it’s worth highlighting that there were 2 different established apartment buildings in the Gold Coast that were acquired for redevelopment between 2019 and 2021, which saw 13 individual apartment owners achieve a combined median capital gain of circa $1.04 Million across an average holding period of just 5.4 years. As these kinds of scenarios are only possible in the established market, these occurrences played some part in seeing the established market outperform the new market.

In closing, there are a number of key projects worthy of specific mention for their capacity to not only deliver built form outcomes that inspire gentrification but their ability to do so at a price that enables considerable financial reward for their buyers. In no particular order, the Gold Coast’s top five performing new apartment projects in terms of median capital gains for initial buyers include the following:

· Sable on Palm by BPG Projects (Palm Beach)

· Acqua Apartments by Cru Collective (Palm Beach)

· Escape North Kirra by GAP Development (Bilinga)

· Boardwalk Burleigh Beach by Morris Property Group (Burleigh Heads)

· Salacia Waters by Lotte Group (Paradise Point)

A total of 68 apartments have been resold for the first time since 2021 across each of these 5 projects at a median capital gain of $247,855 and an average holding period of just 4 years. The NPR Co. is proud to have consulted on two of these top five projects (Acqua Apartments & Salacia Waters) and wishes to extend our congratulations to Cru Collective and the Lotte Group for their success, along with GAP Development, Morris Property and BPG Projects as well.

If any of our readers are eager to learn more details about specific resales results for specific projects or suburbs, please do not hesitate to reach out through any of our listed contacted details.

Tasman Nealon | Property Economist