The Real Challenge

Whilst as a nation we continue to have an obsession with interest rates, in fact one was not sure what was the biggest event last week, the Melbourne Cup or the RBA decision on whether the cash rate would be reduced. The fact remains that in Australia we have an employment issue, or should I more correctly say, an under-employment issue. Contrary to popular belief, this is not something that is the result of the GFC. Australia has experienced a long term under-employment position that stems back to 1992.

However the more recent history shows very clearly the difference between the resource rich states of QLD and WA when compared to the states more closely aligned to international trade and commerce such as VIC and NSW. With the recent world demand for Australian energy and iron ore commodities, underemployment became less of a problem for both QLD and WA. The result being that there was more “cash to splash” in the local economy and individuals were paid more highly than otherwise might have been the case. Just as quickly as it began in Qld, it has demonstrated that it end as abruptly as well. The experience for WA however has been somewhat different as the iron ore price has remained more robust, despite being well off its peak. This is demonstrated clearly in the second graph which compares the price of both thermal coal and iron ore which inversely correlate very closely with the more recent underemployment rates.

What this is now starting to mean on the ground is that the greater degree of robustness in iron ore prices is a considerable driver of employment with the beneficiary being population growth. In this financial year or the next, it is highly likely that the population growth into WA will exceed QLD for the first time ever. This growth is continuing to drive the local economy with the housing recovery well under way. This recovery is anticipated to be sustainable in the short term as the RBA again starts to factor in future rates cuts. This becomes more likely to happen as business confidence continues to wane in most other States and starts to build a case with other less favourable data. Should interest rates continue to moderate and at worst remain stable for some time, the Western Australia recovery is anticipated to again lead the nation.

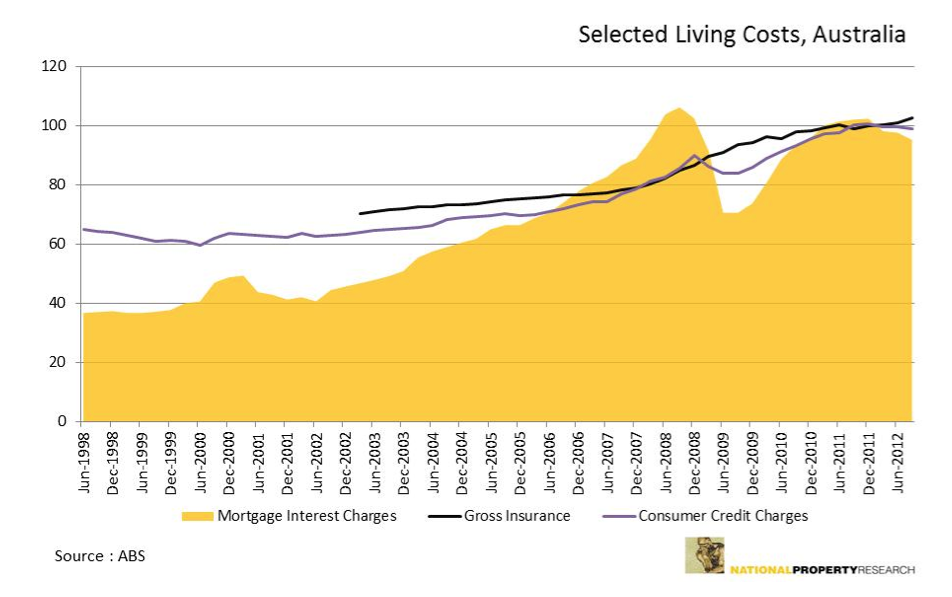

Now for those lucky enough to consider that interest rates are not of any real influence in their day to day living, the reality is very different for much of the population. The final graph in our newsletter looks at the index relating to mortgage repayments, insurance costs and consumer credit costs. This graph tells you very clearly that the RBA and the Banks have the leverage to stimulate the economy or slow the economy depending on a wide variety economic measures…and how much of the interest rate cuts get passed through.

What

this is telling us is that the after tax dollars being spent on mortgage

repayments is near enough to 250% higher than what it was in 1998 before the

two property booms in 2003 and 2007.

At the same time consumer credit costs and general insurance costs have

increased, but not at the rate of mortgages and their respective sizes. For those that are looking skyward

expecting the sky to fall in with a bust to property prices, the only thing

these people are likely to do is go blind staring at the sun…unless they’re

looking at many of the resource towns that are experiencing massive rent

reductions and price declines.

So the real issues that are brought to bear on the property market, be that retail, residential, commercial or industrial remain influenced by employment rates and more importantly under-employment rates. If the underemployment rate can be reduced, we will living costs reduced. If living costs are reduced there will be more money spent in retail, offices and industrial estates will be busier and consumer confidence will rebound. However our State economies need to become more diversified where a hiccup in one resource does not have such a significant impact on so many people.

Solve the underemployment issue and the rest will begin to fall into place.