Brisbane House Prices Lagging

Brisbane House Prices Lagging…nonsense

I find it interesting that some quarters have declared the Brisbane house price as lagging and then later declare that we are in a housing bubble where the prices could drop by as much as 40%. Just go online and see how much worry there is about falling house prices and how overheated the market is.

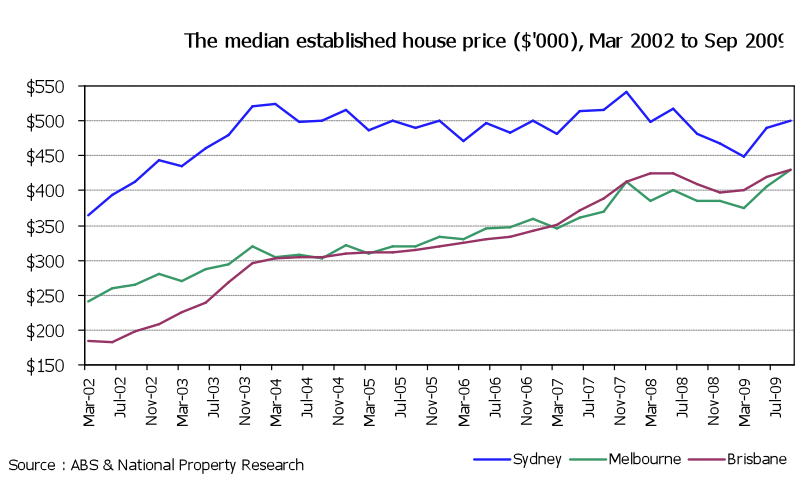

Well, let’s put some perspective around the claim. The below graph demonstrates that the last seven and half years have treated each capital city very differently. What has effectively happened in Sydney is that the end of the first residential boom in 2003, prices in real terms went backwards. Not exactly the fundamentals for what some might term a property bubble. In fact, during the GFC, prices fell by 16% and reflected those achieved in December 2002. So an increase of just $10,000 in the June to September quarter to levels last seen around the 2003/2004 peak are not unreasonable.

Melbourne on the other hand has largely experienced a stable increase in values but has not reached that old real estate chestnut of property doubling every seven years. If one was to look at long term relativities between the cities of the eastern seaboard, Melbourne is probably tracking to trend, Sydney is badly underperforming and Brisbane should moderate in growth for the next two to three years. This is obviously a very simple way of looking at things, but then so is the whole supply and demand rhetoric that people in my profession should know better for using.

Brisbane has been the stand out performer in the past seven years, so those beating up on the city clearly would like to see a boom bust cycle. Moderation in pricing for Brisbane is a healthy thing if volumes are to be sustained. Queensland’s unemployment rate is particularly poor in the current economic climate, it’s credit rating I believe is the worst in the country and politically there is a degree of discontent by the public with both Labor and the LNP. Confidence is not as high as in other States, population growth is waning and this is reflected in the pause in house prices.

It’s not all doom and gloom though. Investors have returned the market, albeit with a degree of caution. However, the biggest problem for this type of purchaser is the stalled construction of investment housing. The current levels reflect that of seven years ago, so not ideal nor surprising given the effects of the GFC. Having stated that, with the economic recovery that is underway and the need to raise interest rates to head off inflation, perhaps some more liquidity needs to be put back into the system to help the construction sector and potentially take some pressure off the rental market.

Houston, we have a problem

That pressure that needs to be taken off the rental market is only going to increase throughout 2010, or more baby boomers are going to renovate as their boomerang children come back home to save.

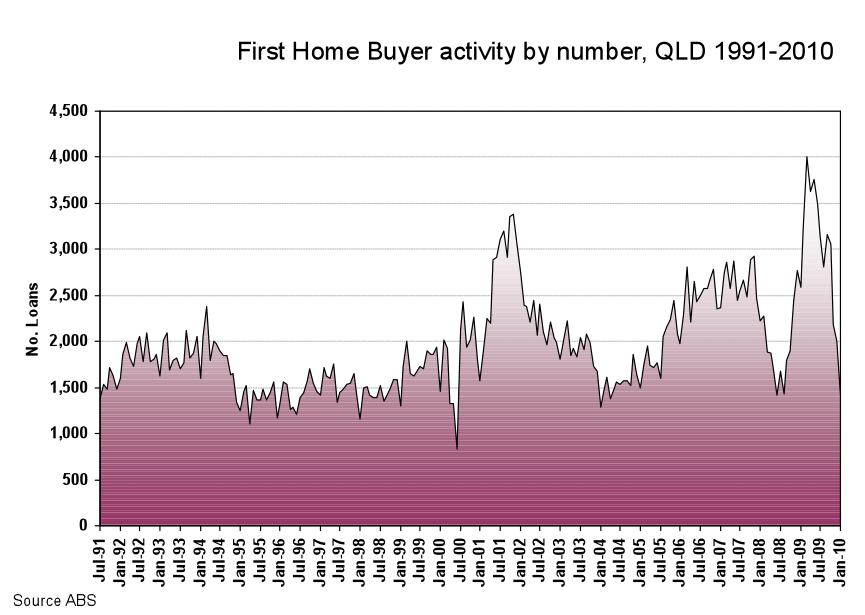

If you wondered how successful the first home owners stimulus package was in getting people into their first property, the graph below demonstrates it very clearly. It also demonstrates what happens when the incentive is removed. FHB loans are back to the levels experienced in the recession of the early 1990’s.

The reality is that we now have two problems. First is the most obvious, how do we get this buyer category active again, irrespective of whether it is new or established residential property. The second is, how do those developers who so heavily geared their development to this buyer change the vision to reflect the current trends of second and third home buyers who are struggling with the concept of small lots.

In our travels, we have seen a great number of projects that lost their way through the past two years and are now dealing with the consequences. It is understood that developers were and remain placed in a particularly precarious position as without sales, everything stops.

First home buyers remain an important part of the property cycle and once again as interest rates increase, rental properties tighten it is this sector which will yield to the economic strain first. If the boost in 2001/2002 taught us anything, it is that this market will take a long time to rebound by itself.